Everybody is superbly happy with the news that Burger King will marry Tim Hortons, and move in to Canada. Shares of Burger King (NYSE: stock) jumped 19.51% to $32.40 while Tim Hortons (NYSE: stock) rose by 18.91% to $74.72 after the closing bell on Monday. The only people who were upset with the merger was Obama administration and supporters who were bitching about “economic patriotism”.

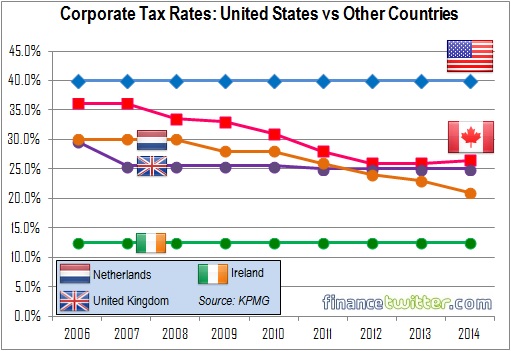

But hey, Burger King is doing business and not a charity house. Using the same logic, perhaps Obama administration and legislators in Washington ought to show patriotism by giving U.S. companies a reason to stay – by lowering tax rate. The fact is, Burger King is not the first nor will be the last company to move their head-quarter overseas, to run away from mind-boggling high corporate tax in the United States.

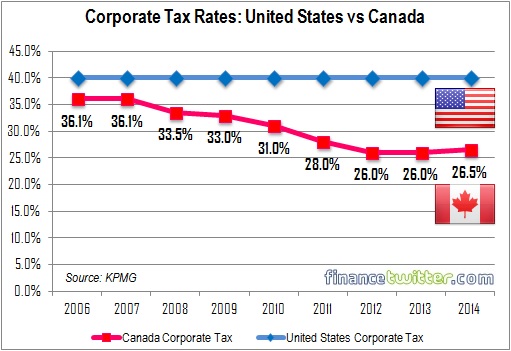

Ever since Canadian Prime Minister Stephen Harper taken over in 2006, he’s been lowering the country’s corporate tax from as high as 36.1% in 2006 to the present 26.5%. And what has President Barack Obama done ever since he was inaugurated as president on Jan 2009? Nothing much except, well, golfing and letting the corporate tax stays at 40% and terrorists ISIL killing, raping, burning and whatnot.

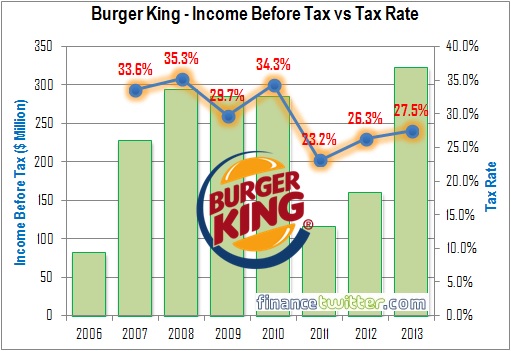

Apparently, Miami-based Burger King will relocate the headquarters of the combined company to Canada and the tax inversion would save tons of money. Combining state and local taxes, U.S. companies can pay as high as 40%, although with “creative accounting” it would be lower than that. For example, Burger King’s effective tax rate in 2013 was only 27.5%, according to its annual SEC filing.

But in Canada, the combination of state and provincial taxes (Ontario) can only goes to maximum 26.5% only. So even if it claimed “no deductions” in Canada, it would still pay a lower rate than it paid in the United States with a “full state of deductions”. David Baskin, president of Baskin Financial Services claimed Burger King could see a mouth watering tax saving of up to 13% after the merger. That’s a whopping extra $41.8 million in pocket money, based on 2013’s income before tax of $322.2 million.

But if you look at the chart above, the tax rate will only goes up with better income for the years to come. Burger King could also be toying with the idea of setting up a foreign affiliate in a low-tax regime such as Switzerland, where the corporate tax is even lower at 17.92%, have the U.S. operations pay income to that affiliate; and repatriate the money back to Canada.

Of course in reality, Burger King together with Tim Hortons will see more than single-digit-million in saving, after all the accounting deductions. Besides, didn’t they say Canada has the second-lowest business costs while America has the highest tax rate among developed countries? But is corporate tax saving the only reason why Burger King is migrating to Canada?

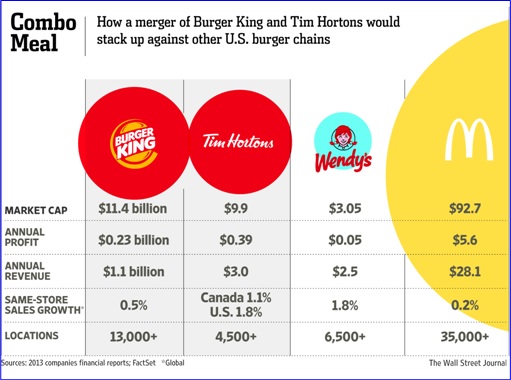

Obviously not. Burger King has been eating McDonald’s dust for ages. Whenever there are special promotions from McDonald’s, Burger King copies to compete. Still, Burger King couldn’t do much to make McDonald’s run for its money. With a merger between Burger King and Tim Hortons, it would create a fast food empire with a market capitalization of about $18 billion (£10.8 billion; RM57 billion), $22 billion in revenue and more than 18,000 restaurants across 100 countries.

It’s not only about size after the merger that matters to Burger King, and Tim Hortons for that matter. Tim Hortons’ famous coffee products can help Burger King swing away McDonald’s strong hold in the quick-serve breakfast market. Uniting Burger King and Tim Hortons would allow a restaurant chain operator to essentially offers breakfast, lunch, dinner and snacks.

Tim Hortons, on the other hand would have direct access to Burger King’s huge network footprint of more than 13,000 locations. Like it or not, Tim Hortons own market in Canada and United States are saturated. The company is still subsidizing some American franchises and has closed some stores. After merger, Tim Hortons can sell burgers for lunch and dinner, the same way Burger King can offer tasty coffee and doughnut for breakfast and snack.

Interestingly, Burger King started as a burger joint in Florida. Later it was bought over by Wendy’s International Inc. in 1995 but spun out in 2006 after came under pressure from activist investor Nelson Peltz. 3G, a New York-based investment firm with Brazilian roots, acquired the then struggling Burger King in 2010 for about $3.3 billion. It then brought Burger King back to the public markets two years ago.

Post merger, 3G Capital, the majority owner of Burger King with about 70% stake, will continue to own the majority of the shares in the new combined entity on a pro forma basis, with the remainder held by existing shareholders of Tim Hortons and Burger King. But how much will burgers maker Burger King pays the Canadian coffee and doughnut chain Tim Hortons?

In order to pacify Canadians over the idea of selling their well-known brand to another “foreigner” again, Burger King is expected to pay top dollar. Raymond James analyst Kenric Tyghe said he expects Burger King to pay between C$85.00 and C$95.00 a share for Tim Hortons, equivalent to a premium of 24% to 38% over its closing price of C$68.78 on the Toronto stock exchange last Friday.

At C$85.00, that would roughly translate to 2.75 shares of Burger King for every Tim Hortons share. But if money is what the Canadians want, no problem, because Wall Street Journal reported that investor Warren Buffett is helping finance the takeover. Apprently, billionaire Buffett’s Berkshire is expected to provide about 25% of the deal’s financing – in the form of preferred shares – to create the world’s third largest fast-food restaurant.

Other Articles That May Interest You …

- Here’s What $100 Is Actually Worth In Each State Of America

- Stunning Revelation – Canadian Taxes Increase By 1,832% Since 1961

- 10 Companies That Control Almost Everything You Buy & Eat

- Where To Get The Cheapest Beers? What’s The Best Selling Beer Brands?

- Here’re 9 Ways Tobacco Companies Make Cigarettes More Deadly

- American Top-20 Best Burger That You Must Try

- Big Mac Index – Cheapest Places To Buy Your Burgers

|

|

August 26th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply