The cost of living is a complicated subject. Unless you’re in a country such as UK where you can basically have free house, food, education and even luxury holidays under “benefits” without working for a day, you need to worry about the cost of living from the moment you leave school. You may not realize it but where you stay has a huge impact on your financial muscles.

While it’s true different countries have the biggest variance in terms of putting money into your pocket, living in different states within a country will still have great impact on your buying power. For example in Malaysia, you still can get a plate of mixed rice with three dishes for RM4.50 in Kuala Lumpur but absolutely not possible in Petaling Jaya – two places separated about 25 kilometers apart.

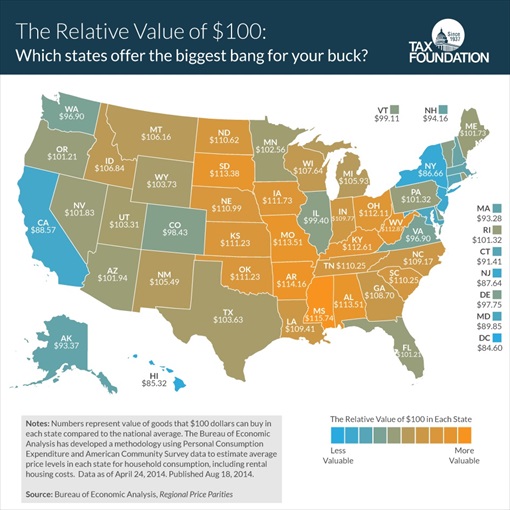

Using data from the Bureau of Economic Analysis, United States Tax Foundation reveals the buying power of every American, depending on which state they stay. Similar to Big Mac Index, the real value of $100 (£60, RM316) differs greatly from one state to another in United States. Obviously in expensive states such as New York or California, you can buy less than those who live in less expensive states such as South Dakota or Mississippi.

Amazingly, the same amount of dollars are worth as much as 40% more in Mississippi than in DC. And the differences become even “larger“ if metro area prices are considered instead of state-wide averages. An American who makes $40,000 a year after tax in Kentucky would need to have after-tax earnings of $53,000 in Washington, DC just in order to have an equal standard of living.

While states with high incomes tend to have high price levels, this is not always true. For example, North Dakota is where you can have high incomes without high prices. That will bring another interesting question – are you considered richer for earning more than your American fellow if both of you live in different state? Apparently not if you stay in New York while your friend is from Kansas.

Although you may earn more working in New York, your real adjusted purchasing power is actually lower than your friend from Kansas. And if your friend is from South Dakota earning the same amount of dollars as you, his purchasing power is about 34% more than you, if you’re from Washington, DC. Interestingly, if you look at the heat map, Americans staying in the center of the country have higher relative value of $100. The value is lesser in the Northwest and West Coast.

The top-5 states with “smallest” real value of $100:

- Washington, D.C. ($84.60)

- Hawaii ($85.32)

- New York ($86.66)

- New Jersey ($87.64)

- California ($88.57)

The top-5 states with “largest” real value of $100:

- Mississippi ($115.74)

- Arkansas ($114.16)

- Missouri ($113.51)

- Alabama ($113.51)

- South Dakota ($113.38)

Hence, if you plan to settle down in certain state or migrate to America, it pays to consider the factor of the real value of $100 done in this study. Of course, if your take home income is so huge that you won’t blink twice about purchasing a mansion, then it doesn’t matter which state you choose to stay.

Other Articles That May Interest You …

- Soros Bet $2.2 Billion On SPY Puts – Does He Know Something We Don’t?

- Stunning Revelation – Canadian Taxes Increase By 1,832% Since 1961

- Here’s A Guide On Cheapest & Best Time For Your Trips To 25 Popular Tourist Destinations

- Here’re 11 Amazing Hidden Messages On Dollar Bills

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

August 20th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply