Many people do not understand why U.S. President Barack Obama and Malaysian Prime Minister Najib Razak are such a close buddies. Flashback, Malaysian longest serving prime minister, Mahathir Mohamad, had to pay “under table money” in the form of lobbyist Jack Abramoff to the tune of US$1.2 million (£800 million; RM4.3 million) so that he can meet President George Bush in May 2002.

As much as Mahathir bitched, whined and cursed American administrations, he happily paid millions of dollars of taxpayers money for a handshake photograph to be beamed around the world. It was money well spent, at least to the hypocrite Mahathir. On the other hand, his protégé, the present prime minister Najib Razak paid nothing for a golfing session with President Barack Obama. Does that mean Najib was more influential than Mahathir?

Heck, not only Najib got invited to golf with Obama in Hawaii, before reluctantly packed for home due to domestic pressure on floods crisis, the former also successfully got the latter to visit Malaysia, much to the envy of Mahathir. Does that mean Najib was more respected than Mahathir? Actually, Obama and Najib have many things in common. Perhaps that’s the reason why both click very well.

Golfing aside, both leaders were considered the lamest duck in the history of their own country’s leadership. Coincidently, both leaders took offices in the same year – Obama on January 2009 while Najib did so on April 2009, only about 4-months apart. Both leaders were also great liars who won’t blink their eyes lying through their teeth. But most importantly, both were big spenders.

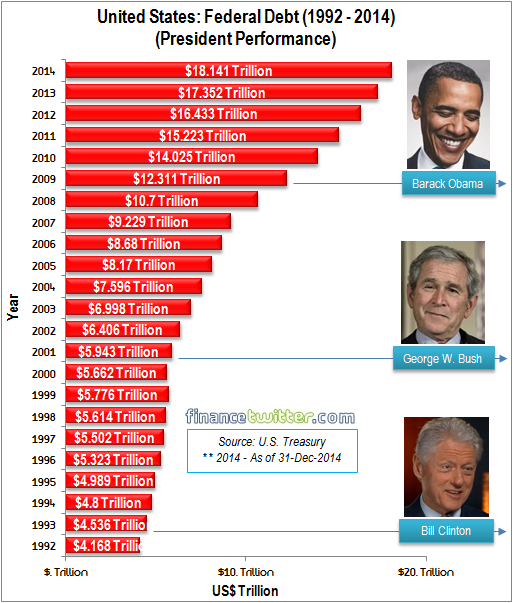

According to the U.S. Treasury, the federal government under President Barack Obama drilled US$789,473,350,613.20 deeper into debt in calendar year 2014. The debt started calendar year 2014 at US$17,351,970,784,950.10 and ended it at US$18,141,444,135,563.30. That’s about US$65 billion every month or roughly US$2 billion burned every day. Didn’t he promise to lower national debt in his first term?

When Obama took office on January 20, 2009, the debt was US$10,626,877,048,913.08. Since then, he has been working extraordinary hard accumulating debt. The president was so successful that he has increased another US$7,514,567,086,650.22 in debt for the United States of America. This means he has increased debt of US$6,875 per household in 2014 alone, and a whopping debt of US$65,443 per household since he became the president.

In terms of percentage, Obama has so far increased the national debt by 70.7% since he took office. His predecessor, George W. Bush increased it by 85.5% in 2-terms (2001 – 2009), primarily due to war in Afghanistan and Iraq. But Bush added only US$4,899,100,310,608.44 in national debt. Bill Clinton was the best performer when he increased the national debt by merely 36.7% during his 2-terms from 1993 to 2001.

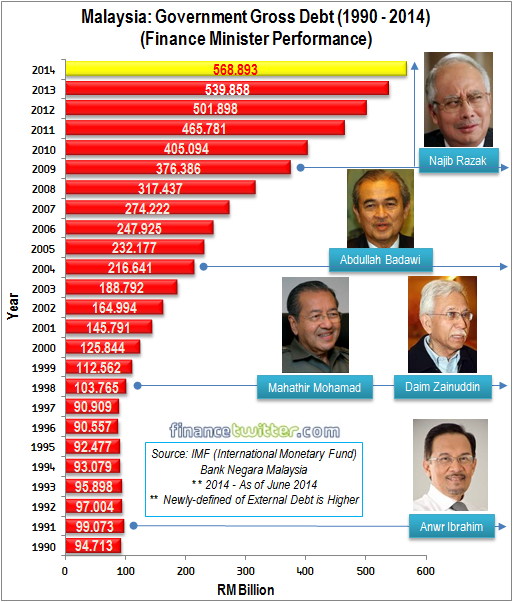

As for economic genius Najib Razak, he has already broken Malaysia’s record in debt accumulation, without much difficulty. Following the government redefinition of “external debt”, the country’s newly-defined external debt stood at a staggering RM729 billion (as of June-2014) or 67.6% of GDP – up from RM696 billion in 2013. Now we know what Obama and Najib discussed during their golfing session – how to increase national’s debt.

Other Articles That May Interest You …

- The Perfect Storm For A Regime Change In Russia, And Malaysia?

- Meet Mahathir, The Only Person Who Can Save Russian Economic Meltdown

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

- Here’s Proof US Govt’s Burning Money – Record High Revenues $2.66 Trillion, But Deficit $589 Billion

- Here’s What $100 Is Actually Worth In Each State Of America

- U.S. Debt – How Much Does Each American Owe?

- Debts & Deficits – 21 Currencies That Have Gone Bust

- Just How Much Is $14.3 Trillion, US Debt Ceiling?

|

|

January 8th, 2015 by financetwitter

|

|

|

|

|

|

|

I believe Malaysia’s Federal Debt is much higher than 569 billion. Even govt figures (and I may be wrong) state it at in excess of RM 600 billion. And dollar denominated debt only increases the burden on the govt when our ringgit depreciates.